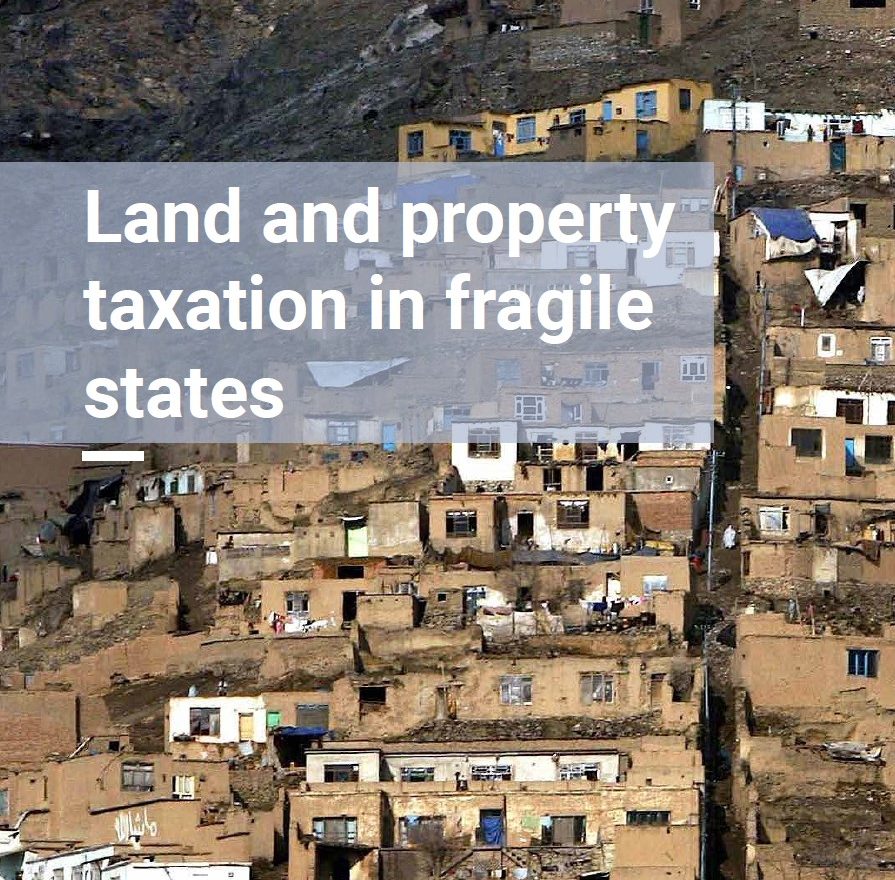

Fragile states typically cannot serve their citizens adequately, and often have weak or authoritarian governments. Conflict, violence and corruption may be widespread, and laws are outdated or difficult to enforce. Skilled staff are hard to recruit; equipment and records may be damaged or stolen in fighting.

But local governments and municipalities must still provide services to their residents, and they need revenue to do so.

One way to raise revenue is by raising their own revenue through taxes on land and property. Land and property cannot be moved (making taxes harder to avoid), and taxpayers have a greater chance to put pressure on the local administration to provide the services they want.

This book examines the experiences if UN-Habitat and its partners in setting up or strengthening land-taxation systems in four fragile states: Somalia, Afghanistan, Palestine and the Democratic Republic of the Congo. It includes five papers:

• Afghanistan (before and during the Taliban takeover in 2021)

• Somalia (focusing on Somaliland and Puntland)

• The use of digital technologies to manage land taxation in fragile states

• Designing interventions for land taxation in fragile states

• Lessons from experiences in Afghanistan, Somalia, the Democratic Republic of the Congo and Palestine.

Land and property taxation in fragile states